Lottery, gas tax, RSA woes were among topics at forum

Published 6:30 am Wednesday, December 7, 2016

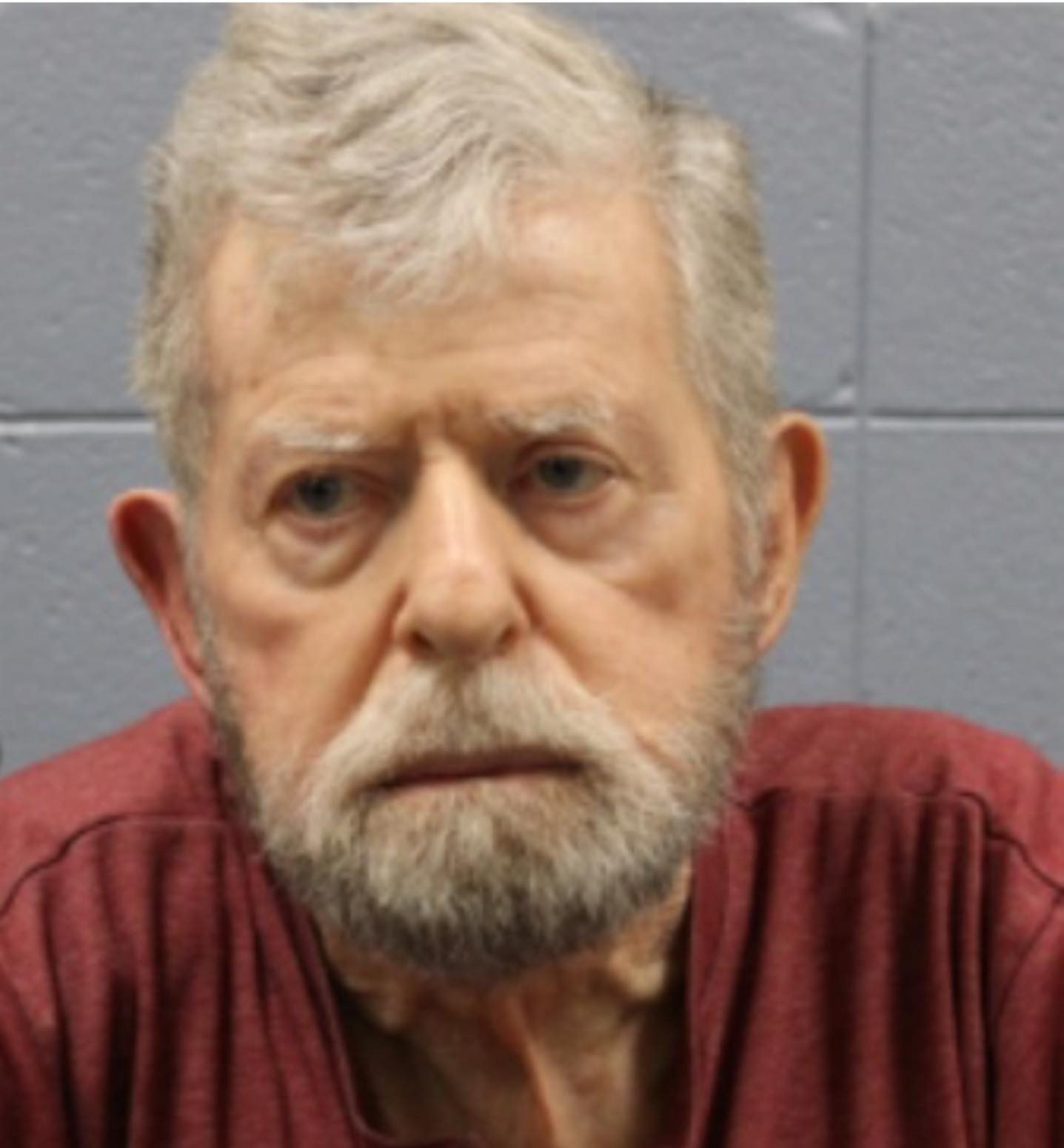

- Alabama Sens. Tim Melson and Arthur Orr, state Rep. Phil Williams, Alabama House Speaker Mac McCutcheon, and state Reps. Lynn Greer and Danny Crawford answered an array of questions Tuesday during a forum at Athens-Limestone Public Library.

Editor’s note: This is the first of a two-part series on Tuesday’s legislative forum at Athens-Limestone Public Library in Athens. Several members of the legislative delegation representing Limestone County answered prepared questions posed by a moderator. The event was hosted by the Greater Limestone County Chamber of Commerce. Part 2 will run in Thursday’s edition.

Six state lawmakers on Tuesday discussed a range of topics affecting residents of Limestone and other counties, including a state lottery, a gasoline tax, ethics reform, how to fix the retirement system, states rights over education, and insurance coverage for autistic children.

Trending

House Speaker Mac McCutcheon, state Sens. Tim Melson and Arthur Orr, and state Reps. Phil Williams, Lynn Greer and Danny Crawford answered prepared questions during a forum at Athens-Limestone Public Library.

The event was hosted by the Greater Limestone County Chamber of Commerce and was sponsored by Athens State University and The News Courier. News Courier Editor Adam Smith moderated and posed the following questions to lawmakers:

Autism coverage

Question for McCutcheon: Alabama is one of only seven states nationwide that does not mandate insurance coverage for autism treatment for all children. This is an issue that is very important to you, so what can be done legislatively to help ease the financial burden on parents who have an autistic child?

McCutcheon: The Department of Mental Health commissioner has been working through a commission to discuss and debate issues concerning autism and insurance coverage.

During some of the studies done on a previous bill several years ago to mandate insurance coverage for children who had autism or were in the autism spectrum, we realized early intervention was the key to try and help them be productive and go out and have jobs, get in schools and maintain grades. We added the autism spectrum into the insurance coverage, which was significant in itself, but it did not go far enough to provide coverage for all of the children in our state.

Trending

There were certain agencies within the state that would provide the coverage. But there were certain agencies — especially some of those agencies under contract through cities and counties — they were not mandated to carry the coverage, so we left a void there.

We began to look at why we could not get coverage. One of the major reasons was the coverage for autism was so expensive for the therapist to administer treatment to these children, the insurance companies said we just cannot afford it, and what we can afford is very limited.

The Mental Health Association got involved and started looking at letting them provide the therapists and a cheaper way of providing ABA therapy for these children. Mental Health has been working on a bill that is being drafted. I’m still in the process of reading through the bill and looking at some of the pros and cons.

There is an issue with age, how many years are you going to cover, when will it start, how are we gonna fund it. There is a thought of maybe letting the state cover that through the Education Department because they are putting out money already for teachers and special needs programs. If we could help these children be more productive and get in the mainstream, it may save the education budget some money on the tail end. I don’t know if that’s where we need to go.

There are many parents who are working for entities in the state that are saying to us, ‘Let us address our companies.’ The insurance coverage — when you spread it across multiple members in an insurance program — would not be as significant… Costs could be as low as 50 cents – we’ve looked at a dollar to 50 cents additional per month to provide coverage. But, in my traveling around the state and talking to different entities that are not covering the autism for their employees, I’ve found some employees are coming back and saying, ‘We don’t mind helping these families but why should I have to increase my health insurance coverage for an issue that is not mine and I get no benefit from?’

…There is going to be some good discussion about this and there is a possibility we can get a public-private partnership going on to help fund insurance for these children. We need to do something because the taxpayer is paying for services that are provided in our public school system already.

…Whether you realize it or not, North Alabama has the highest ratio when it comes to the ratio of autistic children. So, this is a problem we need to address.

Gasoline tax

Question for McCutcheon: You lobbied for a 6-cent gasoline tax increase in 2016 that did not find full support among your colleagues. You’ve said without an influx of money into road projects there will be only $45 million left for all statewide road projects, after the completion of the current Alabama Transportation Rehabilitation and Improvement Program. Given that dire projection, do you think a gasoline tax increase will pass next year? What are our alternatives if it doesn’t pass?

McCutcheon: The discussion is still ongoing. I feel like we made some progress last year. Based on the discussions that we had, I think it was obvious we have an issue that we’ve gotta work on. Is gas tax the answer?

Could we index our fuel kinda like what Georgia did, look at the price of fuel now based on a percentage of what we’re paying in gas tax and set that percentage on the price of fuel. As the price of fuel moves up then, of course, the percentage would go up, which would generate additional revenue. That could be done in such a way that you are really not increasing taxes, you are just aligning the market to increase your dividends coming back in.

I feel like it’s important for us to continue the debate and find a way to improve.

Georgia has addressed its tax, and I just met last night with a group from Tennessee and talked with a legislator who wants me to have a meeting with their speaker. They are fixing to address it going into this next session to even increase their gas tax even more, which put us in a competitive market for jobs in this state.

I’ve seen it happen over and over. Infrastructure is the key to promoting economic growth. We can’t provide businesses places to come in to set up when they can’t get their product up and down the highway. We haven’t addressed our road funding since 1992. You can’t live off what you made in 1992 and we can’t maintain our roads on what we made in 1992.

Is gas tax the answer? I think it could be talked about.

The figures I quoted you came from ALDOT (Alabama Department of Transportation). This $45 million is for road enhancement — we’re not talking about preservation we’re talking about taking a two-lane and making it a four-lane, putting new intersections in, putting up red lights.

If we get down to as low as $45 million for matched money, we’re gonna be in terrible shape in this state, and that’s where we’re headed… I do feel like gas tax needs to be part of the discussion. For us to have the same buying power that we had in 1992 for our roads, that would take an additional 12 cents per gallon…

We have a lot of people who drive through our state. Those people drive on our roads and they help wear them out and we need to get some money from them.

Lottery bill

Question for Crawford: Will the state lottery come up again in the coming year’s legislative session? Where do you stand? Where should the funds be used?

Crawford: In our area, we have the lottery within 14 miles of here anyway… The problem is how do you define it to make sure that when the people vote they are getting what they are voting for? Sometimes there’s gaps in the legislation that folks can interpret to mean online lotteries and things like that.

The governor has appointed a gaming commission, and I guess they are looking at a lot of different options. But, the only thing I support is a paper lottery and letting the people vote on that.

As for funding … our general fund and our roads are our problem. With education it seems like our funding is recovering — we had one of the best budgets we’ve had in about eight years. If that continues, why would you put it (lottery proceeds) all into education when that’s not where your problems are? But, to get it passed, will people vote on it if it’s not for education? So, you’ve got a Catch 22.

Maybe a 65-35 percent (arrangement), with the general fund getting 65 and education getting 35.

Also, how do you run it? Do you run it private or do you start another state bureaucracy?

I am in favor of having a clean bill so you know exactly what you are voting for and when it’s implemented you’re not surprised.

– Read questions and answers for Orr, Melson, Williams and Greer in Thursday’s edition.