Revenue pays for workers and debt

Published 6:41 pm Tuesday, February 21, 2017

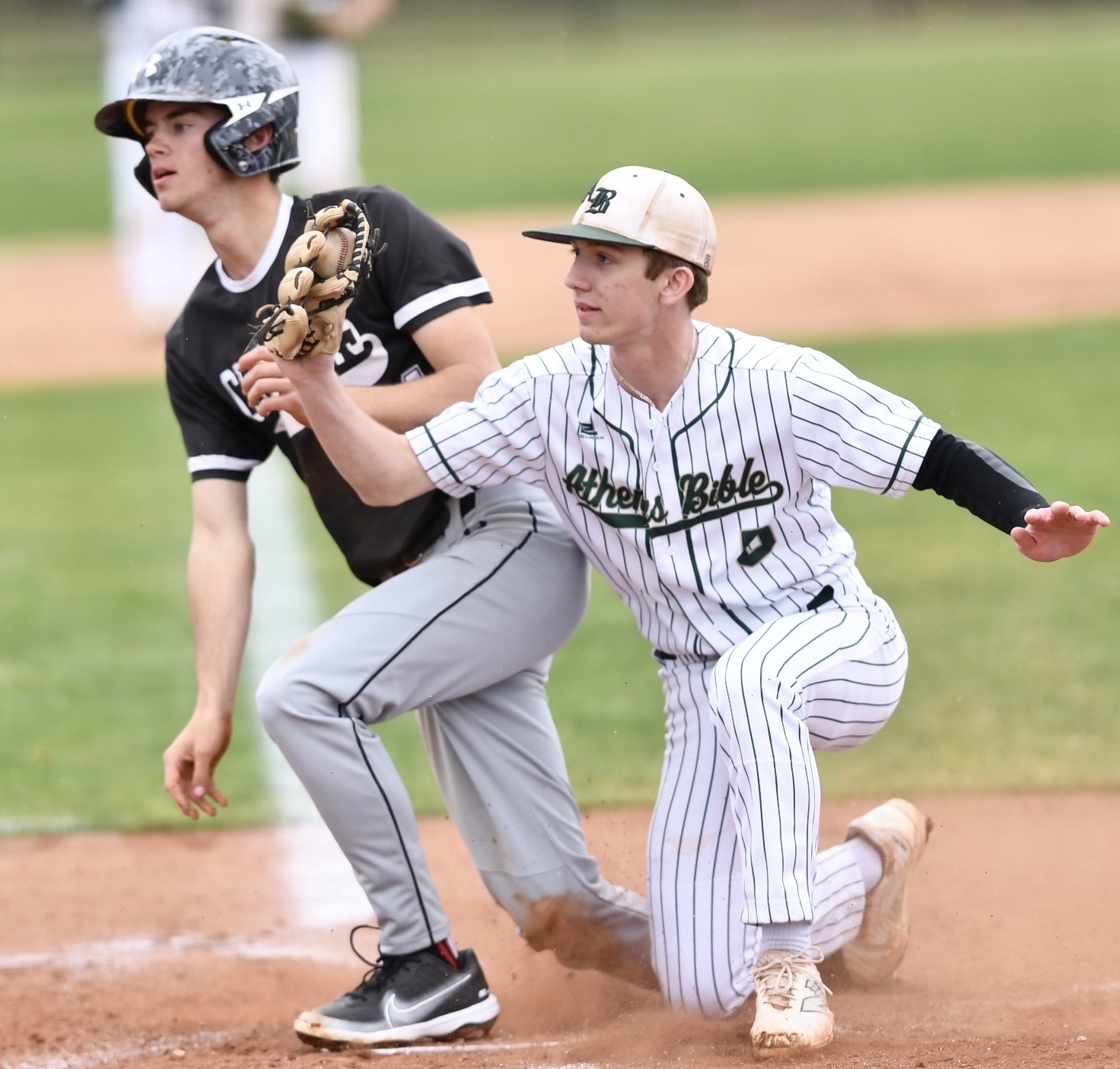

- Limestone County's Sheriff's Office is the county's largest department in terms of personnel and expense with a budget of $9.6 million. That budget includes everything from student resource officers at every county school to animal control, pictured above.

Limestone County’s projected expenses for fiscal year 2016-2017 is roughly $35.7 million and most of those expenditures are paid using revenues from Limestone County residents.

To give you an idea about how your money is spent, consider the fact there are 85 different county departments, agencies or funds that will receive a portion of that money. The county’s largest department and expenditure is the Limestone County Sheriff’s Office, which has projected expenditures of $9.35 million this fiscal year.

Limestone County’s ad valorem tax revenue for fiscal year 2015-2016 added up to a little more than $10.2 million. TVA-in-lieu-of-tax, which is essentially property tax paid by the Tennessee Valley Authority, was anticipated to bring in $1.725 million. The county’s license and revenue revenues were anticipated to be $1.7 million.

Few people know more about county revenues than Emily Ezzell, the county’s finance director. She’s been doing the job for 14 years and considers Limestone County to be in high cotton financially as compared to when she first took the job.

When asked if she could quantify what the county spends ad valorem tax and license revenue on, her answer was simply, “Everything.”

“Anyone who pays property tax is funding some part of county government,” she said.

The county currently has about 260 employees, which includes sheriff’s deputies and anyone working for a county department. Those employees are paid out of the county’s general fund, which adds up to a payroll expensive of about $9.6 million.

Before the start of the current fiscal year, Limestone County Commission Chairman Mark Yarbrough had to make the decision not to provide cost-of-living raises to employees. The county is still recovering from a $7.5 million renovation of the county courthouse and an expansion of the Limestone County Jail that cost more than $4 million. To keep from dipping too far into reserves, the commission agreed to borrow $1.6 million to help complete the courthouse and to pay for jail overruns.

Ezzell said she would have preferred the county not had to borrow the money, but said it was the best option to avoid dipping into reserve funds. As of Sept. 30 of last year, the county was about $19.1 million in debt and had five outstanding general obligation warrants. The county will pay $2.5 million toward its debt in 2017.

These are reasons why revenue is so crucial to the county, Yarbrough said. Unlike Madison, Huntsville, Athens and Decatur, which thrive off sales tax, Limestone County receives no sales tax.

He cited Lawrence County as an example of what can happen when revenues dry up. When the International Paper Mill in Courtland closed, the county commission there was faced with cuts of more than $600,000 to county departments, according to published media reports.

The need to generate more property tax revenue to meet a growing county is one reason why Yarbrough has been proactive in working with state and regional leaders to lure more industries to Limestone County. Those industries are often enticed by a 10-year property tax abatement that doesn’t apply to school taxes. New industries also bring rooftops and the promise of more residential ad valorem taxes.

The 54-year-old Yarbrough, a Limestone native, remains amazed at how the county has grown and prospered in a relatively short time. When he ran for commission chairman in 2014, there were 49,000 registered voters. In the November 2016 general election, there were 58,000.

“I’m always amazed by the growth, but I’ll admit I’m a little nostalgic for the old Limestone,” he said. “We’re blessed to be in this area, but if we don’t continue to grow financially, we’ll face some tough times. When you stop growing, you start dying.”