Making the 2012 penny sales tax count

Published 6:52 pm Tuesday, February 21, 2017

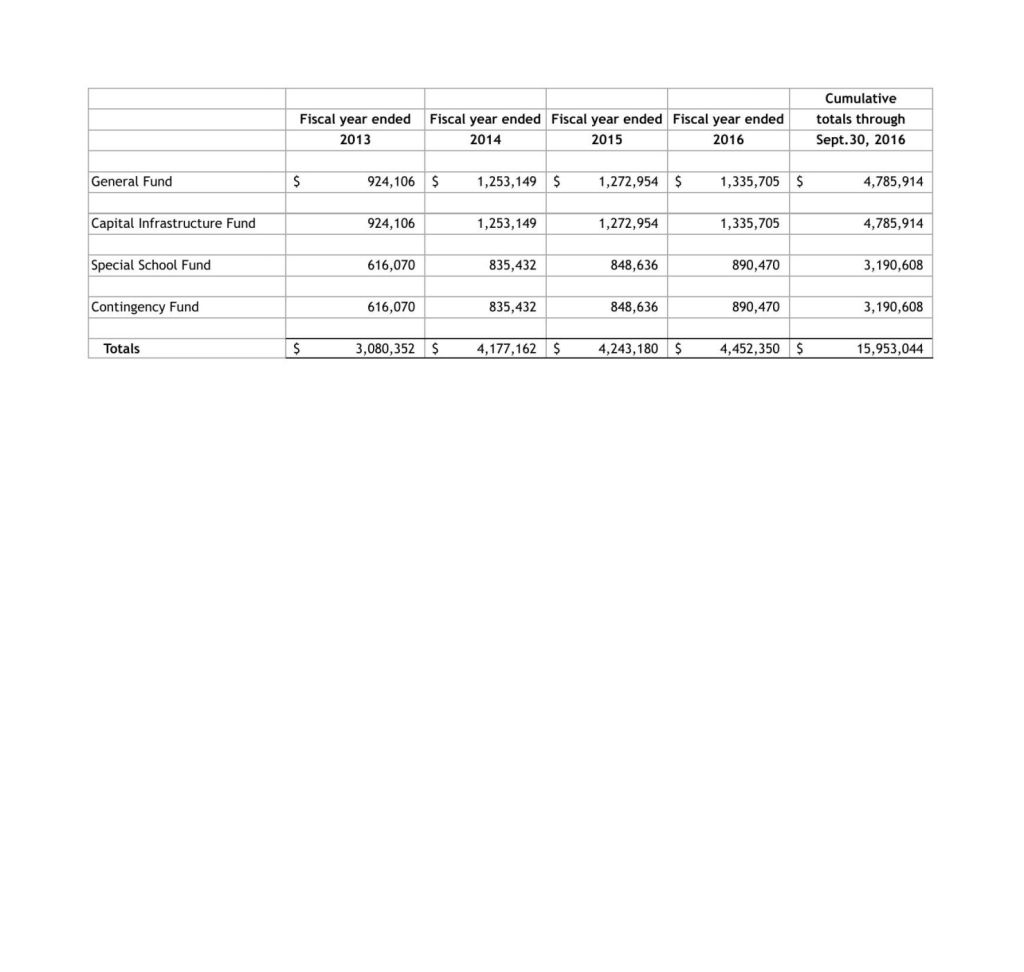

- This spreadsheet shows how much revenue has been generated each year by the additional penny sales tax approved in 2012 by a previous Athens City Council. The money goes into four different funds. In the first fiscal year of the tax, which ended Sept. 30, 2013, only nine months of revenue was generated.

When Athens City Council voted to raise the local sales tax by a penny in 2012, they knew some residents wouldn’t like it.

It was a risk they were willing to take.

Trending

Since then, the extra penny has generated more than $15.9 million, a windfall that has been used to improve education; streets, sidewalks and other infrastructure; replace police and fire vehicles; and pay for many other city projects.

In 2012, Athens’ five council members and Mayor Ronnie Marks determined the increase was needed.

Marks said annual proceeds from the increase would allow the city to tackle overdue maintenance, infrastructure improvements like roads and sidewalks, and fire and police department vehicle replacement.

He said those improvements were needed to help the city attract more businesses and industries that would bring jobs and more tax dollars.

On the day of the vote, four council members voted in favor of the hike — councilwomen Dr. Milly Caudle and Mignon Bowers, both of whom had decided not to seek another term on the council; and councilmen Harold Wales and Jimmy Gill, both of whom had just been re-elected. Councilman Jim Hickman, who had lost his bid for re-election, was the lone dissenter.

On New Year’s Day 2013, businesses in the city limits began charging consumers an additional 1 percent sales tax, bringing the total sales tax to 9 cents on every dollar.

Trending

The mayor and council had a well-defined use for the monies before voting for the increase, which has made it easy to see what benefits have come from it. They started by allocating the additional revenue from the penny into the following four funds:

• 30 percent — General Fund;

• 30 percent — Capital Infrastructure Fund;

• 20 percent — Special School Fund; and

• 20 percent — Contingency Fund.

Here’s what the city has been able to purchase with the additional penny, according to City Clerk Annette Barnes Threet:

Capital infrastructure fund (30 percent)

The funds from the capital infrastructure have been used for the city’s paving projects, Threet said.

The council has appropriated 50 percent of the estimated annual revenues of $1.2 million allocated to the capital infrastructure fund for meeting the match requirements of the Alabama Transportation Rehabilitation and Improvement Program, she said.

ATRIP, as most call it, is an Alabama Department of Transportation-administered federal aid highway program that funds up to 80 percent of the construction of important roadway projects.

“The city of Athens has been awarded ATRIP funding in three phases totaling projects of just under $9 million,” Threet said. “Without the revenue from the additional one penny to fund the 20 percent match required by ATRIP, the council would not have been able to use these grant funds.”

The other 50 percent of the $1.2 million estimated annual revenues has been appropriated by the council to fund non-ATRIP paving projects, such as major roads, neighborhood streets and sidewalks, she said.

“One important fact to note is that prior to having the revenues for paving generated by the additional one-cent sales tax, the city’s total paving budget came from gasoline-tax revenues, which were only about $240,000 annually,” Threet said.

Special School Fund – 20 percent

Of the $3.2 million allocated to the Special School Fund since the inception of the additional 1-cent tax, $2.2 million has been appropriated for the Athens Board of Education’s Power Up Program, a program trying to put laptop computers into the hands of all Athens students.

There has also been a one-time special appropriation of $273,000 for renovations to the former Athens-Limestone Public Library, which were necessary to convert the space for use as the Renaissance School, Threet said.

Approximately $1 million remained of the fund as of Thursday. It will be used to make debt payments on the schools’ 2016 warrants issued for construction of the new high school off U.S. 31, she said.

Contingency Fund – 20 percent

Of the cumulative $3.2 million allocated to the Contingency Fund since the inception of the 1-cent tax hike, $250,000 was appropriated to pay the council’s three-year commitment for the Remington industrial incentive, Threet said.

Also, the council appropriated $350,000 in January 2016 for additional paving, and they appropriated $1.3 million in December 2016 for the city’s four-pod ballfield construction project at the Sportsplex, she said. A $1.35 million balance remains.

“By allocating the additional $350,000 for paving, this brought the city’s overall paving budget to $1.1 million for 2016, made up of the $350,000 from the Contingency Fund, $600,000 from the Capital Infrastructure Fund and $150,000 from gasoline tax funds,” Threet said.

This pooling of resources has allowed the city to address paving in a way it never had before.

General Fund – 30 percent

The cumulative $4.78 million allocated to the General Fund is part of the General Fund operating budget. It funds a variety of expenditures.

“One priority for the council has been public safety,” Threet said. “Due to the additional revenue generated by the additional tax, the council was able to adopt a new public safety pay scale effective April 6, 2014, at an annual cost of approximately $150,000.”

Other projects funded through General Fund revenues since 2013 have been the Piney Creek Sewer Project ($300,000), grant matches for both the All Kids Park and a community storm shelter ($100,000), fees for design and drainage costs for the proposed new four-pod ballfield project ($215,000), additional funding for paving downtown streets ($290,000) and funding for departmental capital requests such as police cars, street and sanitation equipment, fire department turnout gear and parks and recreation equipment totaling $2,600,000, Threet said.