Harrison, Hill not hot on proposal to hike gasoline tax

Published 6:30 am Saturday, December 10, 2016

Limestone County Commissioner Ben Harrison knows the county and state need more road money but he also believes the county needs to try to improve road durability and stretch paving dollars before considering an increase in the gasoline and diesel tax.

Harrison and Limestone Commissioner Stanley Hill represented the county at the Association of County Commissions of Alabama meeting Thursday in Montgomery.

Trending

Association members voted to seek legislative approval of a $1.2 billion bond issue for road construction during next year’s legislative session. The plan calls for a 3-cent tax on gasoline and diesel fuel to repay the debt, according to The Associated Press. The tax would expire when the bonds are paid off.

A bill to raise the gasoline tax by 6 cents a gallon failed in the Legislature this year, and similar proposals died last year, according to The AP.

The new legislative session begins Feb. 7.

53 in favor

None of the 53 counties attending the association meeting voted against the plan, said ACCA Executive Director Sonny Brasfield.

Harrison, who had another engagement, had to leave the meeting before the vote.

Trending

Hill said the association simply asked for “yeas” and “nays,” not a roll-call vote on the matter. He didn’t offer an endorsement of it on Friday.

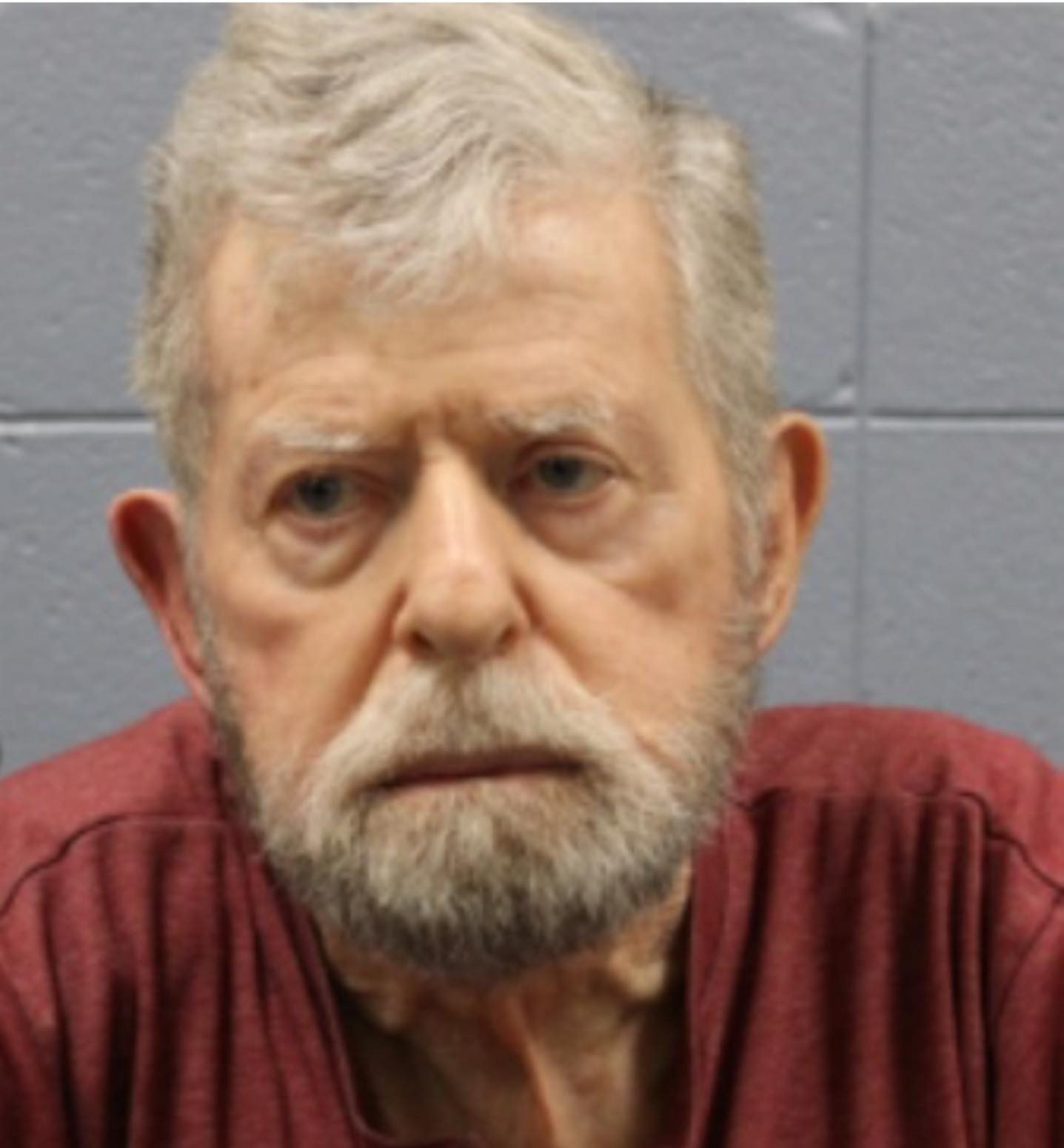

Hill

“I think a lot more counties would be in favor of it if they could spend the money on the roads they need to and if they didn’t have ALDOT put requirements and specifications on them,” Hill said. “You can build a good road without their (ALDOT’s) specs. It depends on the amount of travel the road is going to get. Some roads aren’t traveled as much.”

Harrison

“We do need the revenue,” Harrison said. “But, my personal view is we need to work on costs first. There are trust issues with the voters in terms of how costs have gotten out of hand.

“The cost of materials versus the revenue coming in has tripled, so we can only do about a third of what we could do 12 years ago,” he said.

Costs tripled after the cost of oil went up to about $150 per barrel, he said. Even though the cost per barrel has gone down, the cost of materials has not.

“We first have to look at how we can streamline — make the roads last longer and make the dollars stretch further. But, we cannot make up triple the cost. We cannot reduce our cost of operations and cost of constructing roads back to the 2004 level.

“We can, maybe, knock off a third just by doing best practices — like soil stabilization — getting the soil and base correct before putting expensive topcoats on. We are making some progress there.”

He said what many people don’t realize is that because the cost of road material has tripled, the gasoline tax paid in 2004 went much further than it does today.

Plus, unlike sales tax, which is a percentage, gasoline tax is a number of cents.

“Whether the price of a gallon is $1 or $3, you’re still only paying that 3 cents,” Harrison said. “The solution needs to be to put it on a percentage like everything else.”

Roadwork is petroleum based — the making of the asphalt and the cost to transport it to the worksite.

He said there would be no way for the people to vote on whether to raise the gasoline or diesel tax increase.

“I wish there were,” Harrison said. “It really needs to come from the voters.”