Another tax takes a holiday

Published 8:49 pm Monday, June 19, 2006

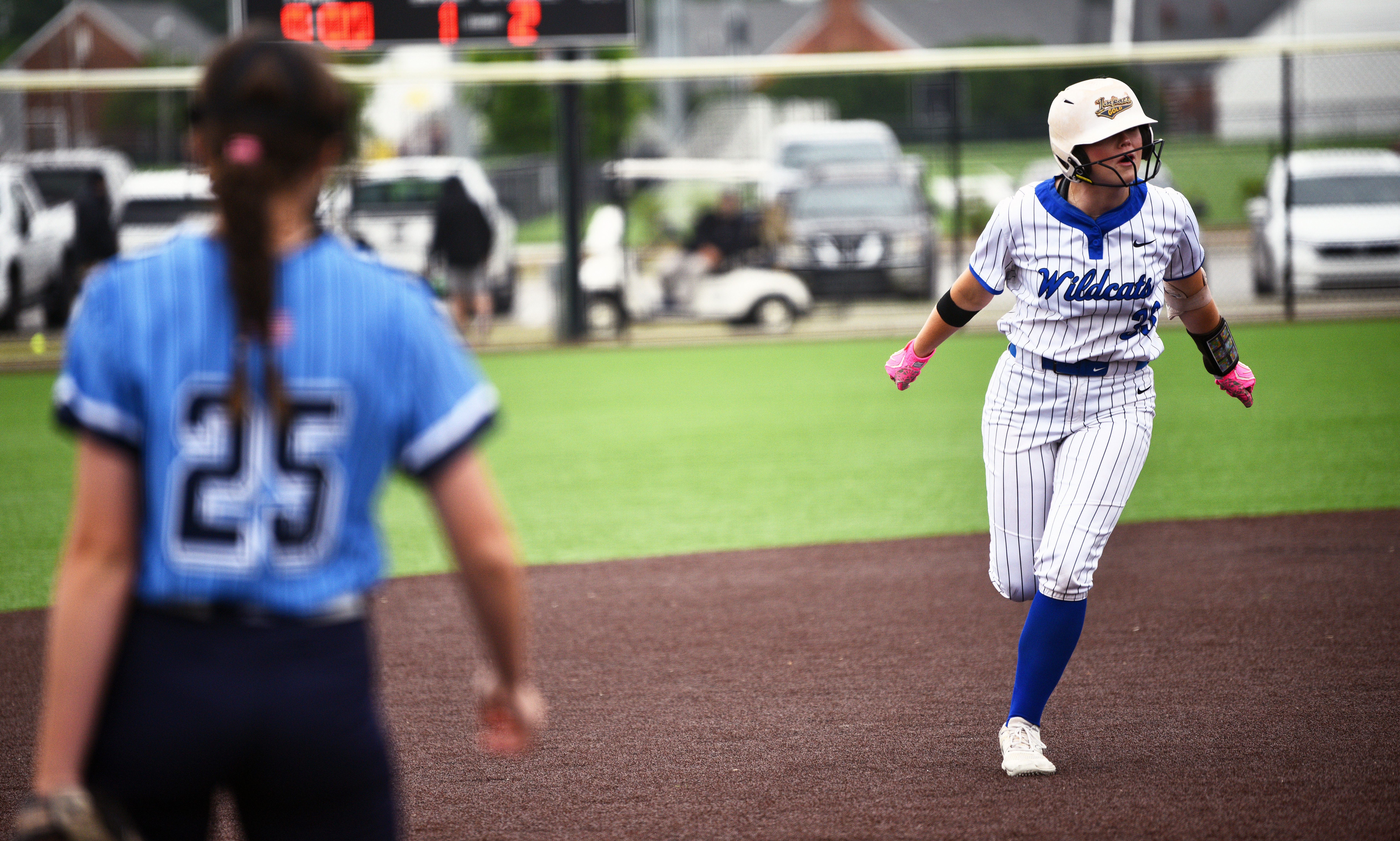

- Off Campus Bookstore employee Amanda Duren rings up school supplies for Misti Vinson. Supplies like those at right are included in the sales tax holiday Aug. 4-6 approved by the state and county. Will the city be next?

Back-to-school shoppers now will save an additional 2 cents per dollar on purchases made Aug. 4-6 after the Limestone County Commission voted to observe a sales tax holiday in conjunction with the state.

The Alabama Legislature passed a law April 25 allowing people to purchase school supplies and clothing without paying state sales tax during that weekend as a way to help families defray the expense of sending kids to school. The governor encouraged cities and counties to offer their own tax waiver.

Limestone commissioners approved the measure at a Monday morning meeting.

“We thought since every other entity was in the process of doing that, it could end up being counterproductive if we chose not to do it,” said Commission Chairman David Seibert. “In other words, people would shop in another area. Plus, we’d like to help the citizens we know. It’s a big expense with kids going to school

Athens Mayor Dan Williams said city councilmen would discuss waiving the 2 cents per dollar collected by the city at a meeting Monday night.

“I’m not sure if it’s on the agenda (for a vote), but we’re at least going to talk about it,” Williams said. “I think everybody’s in favor of helping out the folks sending kids back to school.”

Williams said of the city’s 2 cents, one goes into the General Fund, and the other is given to the city school system.

“If we’re going to abate it, we’re going to abate all of it,” he said. “I think anybody needs a tax break any time they can get it.”

But because the items for which taxes can be waived are limited, the mayor is concerned the tax holiday will cause problems for merchants.

“By the time they limit it, it’s probably going to be more trouble than it’s worth,” he said. Many businesses use computerized cash registers that add sales tax automatically, so removing a percentage of the tax on only particular items could be confusing.

Seibert said voting to waive the county tax helps make Limestone “competitive with surrounding areas.” He did not know how much tax revenue the county would lose during that period.

According to the bill signed by the governor, the tax holiday would save state residents $3.3 million over the three-day weekend.

The tax waiver applies to:

• clothing costs up to $100 per item;

• computers, software and computer supplies costing up to $750 per item;

• school supplies and textbooks up to $50 per item; and

• other books up to $30 each.

Twelve other states, including Georgia and Florida, have passed similar sales tax holidays on back-to-school purchases.